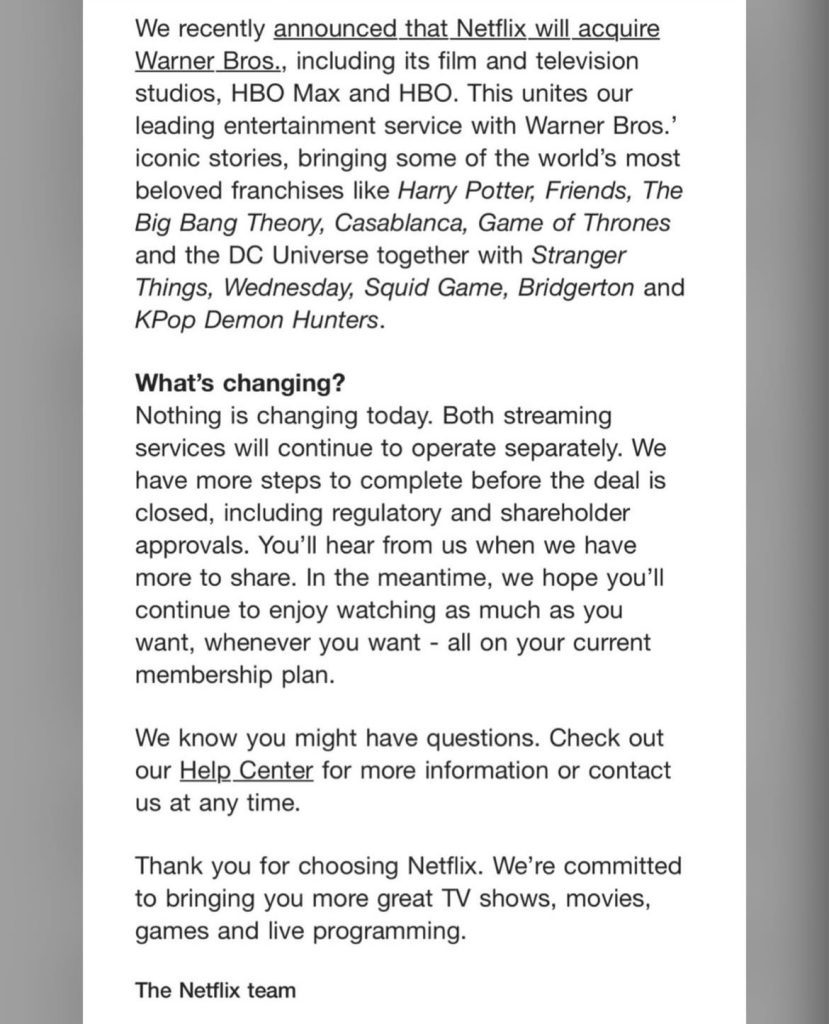

Netflix’s successful bid to acquire Warner Bros. Discovery’s (WBD) film, TV studio, and streaming assets for an estimated $72 billion has immediately sparked intense regulatory scrutiny. Following the deal’s announcement on December 5, 2025, reports indicate a formal Netflix WBD Acquisition Letter was sent to the White House and regulators.

This letter, from Congressman Darrell Issa, reportedly warned the Department of Justice’s antitrust division that the merger would grant Netflix “unequaled market power.” The concerns focus on the streaming giant consolidating WBD’s deep library, including HBO, DC Comics, and Harry Potter, which could stifle competition in Hollywood.

The $72 Billion Deal & Regulatory Hurdle

The transaction, which will see Netflix acquire WBD assets following the separation of its cable networks, marks the end of a competitive bidding war. The acquisition solidifies Netflix as the undisputed global content powerhouse.

However, the reported Netflix WBD Acquisition Letter confirms that the company is bracing for a protracted regulatory review. Antitrust officials are reportedly concerned that the combined entity would possess too much sway over content production and distribution, potentially triggering an investigation similar to those faced by Google and Amazon. The deal is expected to close in 12–18 months, pending shareholder and regulatory approvals.